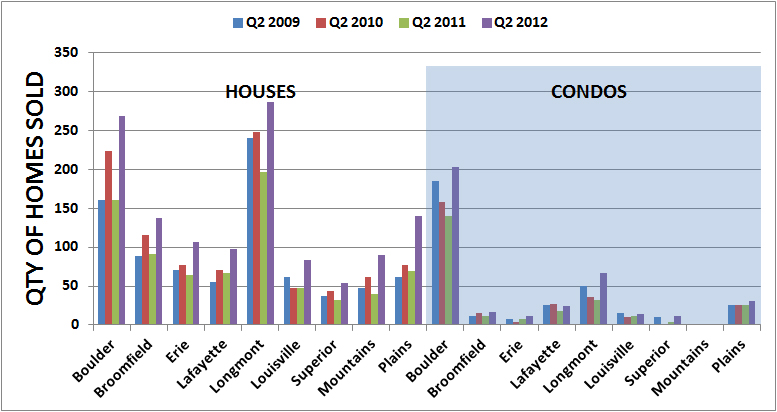

Quantity of Homes Sold

Quantity of Homes Sold: The local market has been VERY active! The number of sold properties (both homes & condos/townhomes) is up across the board in all communities of Boulder County. Boulder specifically has seen a verity dramatic 23% increase in the number of sold homes and a 30% increase of sold condos/townhomes for the 2nd quarter of 2012 vs. 2nd quarter 2011. It is also worth noting that the 2nd quarter of the year is indeed the heart of the busy selling season, but we experienced the highest number of solds in the last 4+ years.

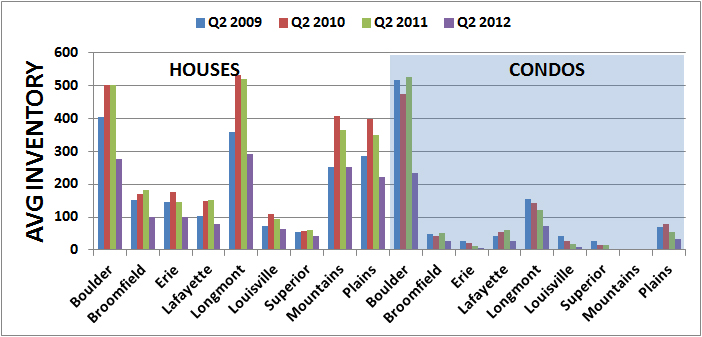

Average Inventory

Average Inventory: The limited amount of homes & condos/townhomes for sale this year has created a "buyer frenzy" dynamic throughout the 2nd quarter. With 4+ year lows in available inventory throughout every community in Boulder County, there truly has been more buyers in the market place ready to buy with little to choose from. So this has created multiple offer scenarios, as well as some properties selling about their asking price. The terms "hustling & sprinting" have described my role as a buyer's agent when new properties came onto the market.

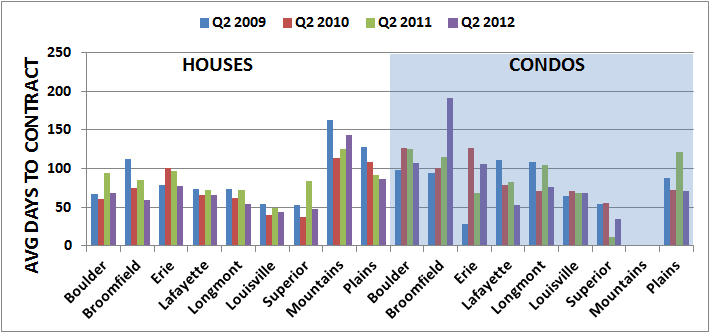

Days to Contract

Days to Contract: The 2nd Quarter saw an overall downward trend of the total number of days on market (DOM) for properties almost entirely throughout all communities of Boulder County in both homes & condos/townhomes. Boulder-specifcally saw a 26 % decrease in DOM for homes (2Q 2012 67 DOM vs. 2Q 2011 91 DOM) and a 15% decrease in DOM for condos/townhomes (2Q 2012 126 DOM vs. 2Q 2011 107 DOM). Only a few local markets saw an upward trend in the 2nd quarter of 2012 DOM: Mountain Homes (+8%), Broomfield condos/townhomes (+23%) and Superior condos/townhomes (+8%).

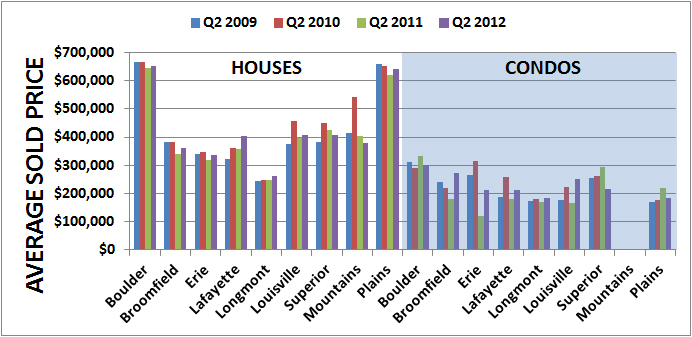

Average Sold Price

Average Sold Price: The overall average sold price of Boulder homes dropped slightly at 1% (2Q 2012 $649,785 vs. 2Q 2011 $655,574) and Boulder condos/townhomes dropped 8% (2Q 2012 $304,308 vs. 2Q 2011 $331,908). The only other decreases in average sold prices for the 2nd quarter were seen in Superior (homes 6% decrease & condos/townhomes 28%) while Mountain homes also saw a decrease in the average sold prices. All other Boulder County communities experienced increases (2012 vs. 2011) in the overall average of sold prices for the 2nd quarter.

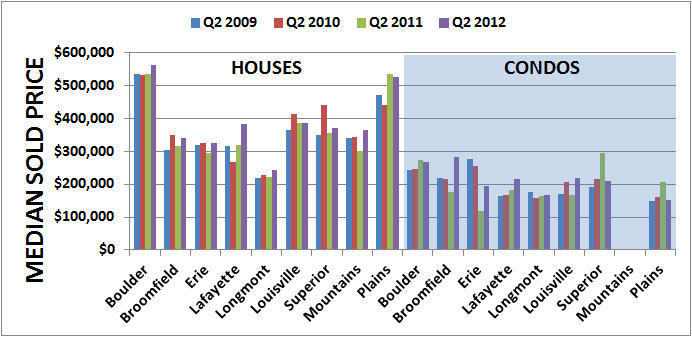

Median Sold Price

Median Sold Price: The truest insight into the "value" of the local market & trends is to look closely at the Median Sold Prices, at Boulder County homes saw gains for the 2nd Quarter. Boulder homes saw an increase of 5% ($560,000 2Q 2012 vs. $533,000 2Q 2011) while Boulder condos/townhomes saw a decrease of 5% ($259,000 2Q 2012 vs. $273,000 2Q 2011). Other significant observations were as follows: Lafayette homes saw a 23% increase ($373,765 2Q 2012 vs. $302,000 2Q 2011), Mountain Properties saw a 20% increase ($349,500 2Q 2012 vs. $291,300 2Q 2011), while Superior condos/townhomes saw a 39% decrease ($180,000 2Q 2012 vs. $295,000 2Q 2011).